This is an outdated version published on 2022-10-21. Read the most recent version.

Preprint

/

Version 2

Yield and Volatility of TSMC under this Turn’s Interest Rate Policy

DOI:

https://doi.org/10.58445/rars.34Abstract

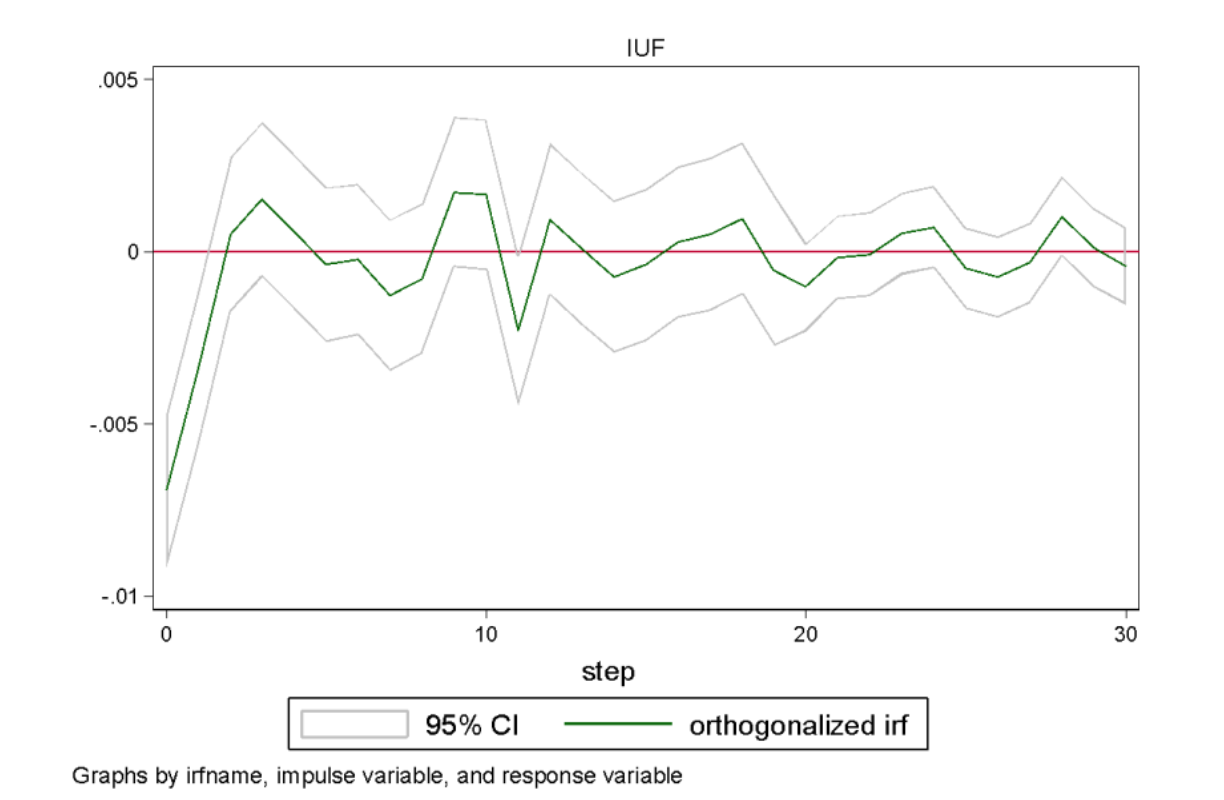

The Federal Reserve Board of Governors made the decision to increase the target range for the federal funds rate for the fourth time in 2022 on July 27. Due to the fact that many global events took place, such as the Covid-19 Pandemic, the China-US trade war, and the Russia-Ukraine war, these changes brought about the worst economic collapse seen in the United States since the Great Depression, which led to the highest inflation rate seen in the 21st century. The decision was made by the government of the United States to raise the federal funds rate in order to reduce inflation and achieve market stability and smoothness. The effects of rate rise by the Federal Reserve are substantial in a variety of contexts, particularly in the semiconductor sector. This research chose a well-known Chinese company, Taiwan Semiconductor Manufacturing Company, and intercepted its stock data from 2019 to 2022. It then used both the VAR model and the ARMA-GARCH model to simulate and analyze the data, studied the influence of Fed rate hikes on this Chinese semiconductor company’s yield and volatility rate, also made a future prediction of this Chinese semiconductor company’s development, and finally offered some comments and suggestions for the company.

Additional Files

Posted

2022-10-21 — Updated on 2022-10-21

Versions

- 2022-12-20 (3)

- 2022-10-21 (2)

- 2022-10-21 (1)