A Comparative Analysis of Modern Monetary Theory and Textbook Economics

DOI:

https://doi.org/10.58445/rars.55Keywords:

monetary theory, EconomicsAbstract

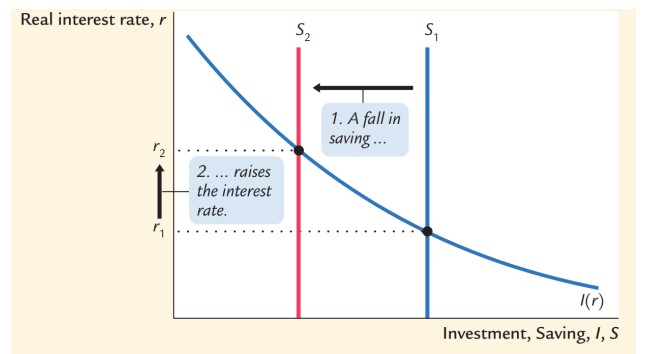

The current economic framework within which policy is developed seems incapable of addressing climate change. Even policymakers who acknowledge the magnitude of the problem are avoiding real solutions, not knowing how solutions can be funded. But is that the end of the debate? Are there other economic paradigms that we should seriously consider? Will climate change destroy the planet before we can come up with the money to pay for solutions? Not finding answers in introductory economics courses, I stumbled upon Modern Monetary Theory (MMT), a new macroeconomic paradigm that shows how the government can actually fund solutions for the climate crisis. In introductory economics courses, we are taught that any government is financially constrained by how much it can raise through taxes or borrowing. MMT explains that currency-issuing governments (like the U.S. federal government) are not financially constrained, because their spending creates new money. MMT confused me initially because it overturned all the economics I had learnt in class. As someone who has done introductory courses in Economics 101 (textbook economics) as well as MMT, I would like to show how the two approaches differ in their views on government spending, government debt, bank lending, interest rates, and money. Through this, I would like to show how MMT is a paradigm shift in economic thinking that can lead our generation to real climate solutions.

References

Berkeley, A., et al. (2022). The self-financing state: An institutional analysis. UCL Institute for Innovation and Public Purpose the_self-financing_state_an_institutional_analysis_of_government_expenditure_revenue_collection_and_debt_issuance_operations_in_the_united_kingdom.pdf (ucl.ac.uk)

Board of governors of the Federal Reserve System. (n.d.). Retrieved from The Fed - Federal Open Market Committee (federalreserve.gov)

Driessen, G.A., Gravelle, J.G. (2019). Deficit financing, the debt, and “modern monetary theory” - congress. Deficit Financing, the Debt, and “Modern Monetary Theory” (congress.gov)

Keen, S. (2020). Introduction to the Minsky models of modern monetary theory. YouTube. Introduction to The Minsky Models of Modern Monetary Theory #TMMOMMT #MMT - YouTube

Kelton, S. (2020). The deficit myth: Modern monetary theory and the birth of the people's economy. Public Affairs, Hatchette Book Group.

Mankiw, N. G. (2003). Macroeconomics. Worth Publishers.

Mcleay, M., et al. (2014). Money creation in the modern economy. Bank of England. Retrieved from Money creation in the modern economy | Bank of England

Mcleay, M., et al. (2014). Money in the modern economy: An introduction. Bank of England. Money in the modern economy: an introduction | Bank of England

Nikoforos, M., Zezza, G. (2017). Publications. Stock-flow Consistent Macroeconomic Models: A Survey | Levy Economics Institute. Stock-flow Consistent Macroeconomic Models: A Survey | Levy Economics Institute (levyinstitute.org)

Raworth, K. (2022). Doughnut economics: Seven ways to think like a 21st-century economist. Penguin.

Real-World Economics Review - paecon.net. (2019). whole89.pdf (paecon.net)

Wray, L.R. (2019). L. Randall Wray testimony before the House Budget Committee, 11/20/2019. .L. Randall Wray Testimony before the House Budget Committee, 11/20/2019 (levyinstitute.org)

FRED database: fred.stlouisfed.org

Minsky model links:

i. Installer: https://drive.google.com/file/d/12mavWPMva5OF-v8LhkqhZvxlk-wzzHBJ/view?usp=sharing

ii. Finished model: https://drive.google.com/file/d/1RVEfPIx3GTX-TQ3562c8AkEe8JeTM6px/view?usp=sharing

Downloads

Posted

Versions

- 2022-12-24 (4)

- 2022-12-24 (3)

- 2022-12-24 (2)

- 2022-11-02 (1)

Categories

License

Copyright (c) 2022 Rishabh Balamitran

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.